Fraud Prevention Network 3511579644 3208227024 3426113246 3313133403 3756545747 3701297301

The Fraud Prevention Network serves as a critical framework for enhancing financial security across various sectors. By facilitating collaboration among stakeholders, it harnesses data sharing to combat fraudulent activities. Key identifiers play a significant role in this process. However, the effectiveness of strategies like behavioral analysis and continuous monitoring raises questions about their adaptability in an evolving digital landscape. Understanding these dynamics is essential for fostering resilience against emerging threats. How can institutions better leverage these strategies?

Understanding the Role of the Fraud Prevention Network

How does the Fraud Prevention Network operate within the broader landscape of financial security?

This network enhances fraud detection through strategic network collaboration among various stakeholders. By sharing insights and data, it fosters a unified approach to identify and combat fraudulent activities.

Such collaboration empowers financial institutions, enabling them to safeguard consumer interests while promoting a secure environment conducive to economic freedom and integrity.

Key Identifiers and Their Significance

The effectiveness of the Fraud Prevention Network hinges on the identification of key indicators that signal potential fraudulent activities.

Significance analysis of these key identifiers enhances fraud detection capabilities, thereby improving overall network efficiency.

Strategies for Detecting Fraud

Implementing effective strategies for detecting fraud requires a multifaceted approach that leverages data analytics, behavioral analysis, and technology.

By deploying advanced fraud detection techniques, organizations can identify patterns indicative of suspicious behavior. Continuous monitoring and real-time data processing enhance the ability to flag anomalies, allowing proactive intervention.

This comprehensive framework empowers entities to safeguard their resources while promoting a culture of transparency and accountability.

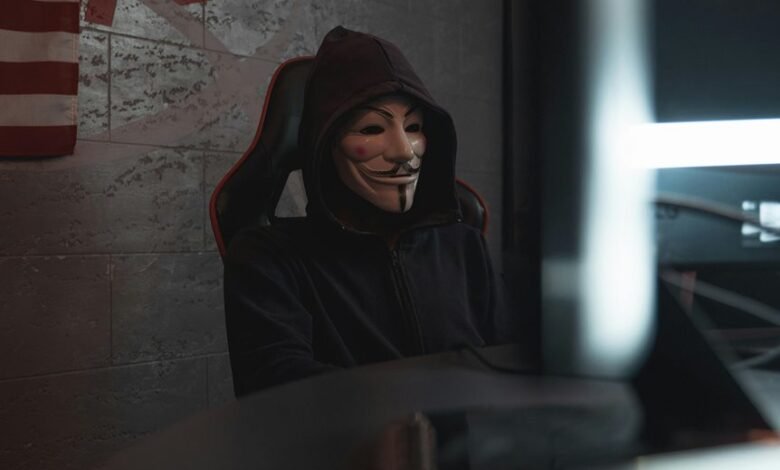

Building a Safer Digital Environment

Creating a safer digital environment necessitates a strategic focus on robust cybersecurity measures and user education.

Enhancing digital security involves implementing advanced technologies and fostering a culture of online safety. By prioritizing awareness and proactive behavior, individuals and organizations can mitigate risks associated with cyber threats.

Empowering users with knowledge and tools is essential for cultivating resilience in an increasingly interconnected digital landscape.

Conclusion

In conclusion, the Fraud Prevention Network stands as a vigilant guardian in the realm of financial security, weaving a robust tapestry of collaboration among stakeholders. By employing key identifiers and advanced strategies, it not only fortifies defenses against fraud but also cultivates a culture of trust and resilience in the digital landscape. As cyber threats continue to evolve, this proactive approach ensures that consumer interests remain safeguarded, ultimately fostering a more secure economic environment for all.